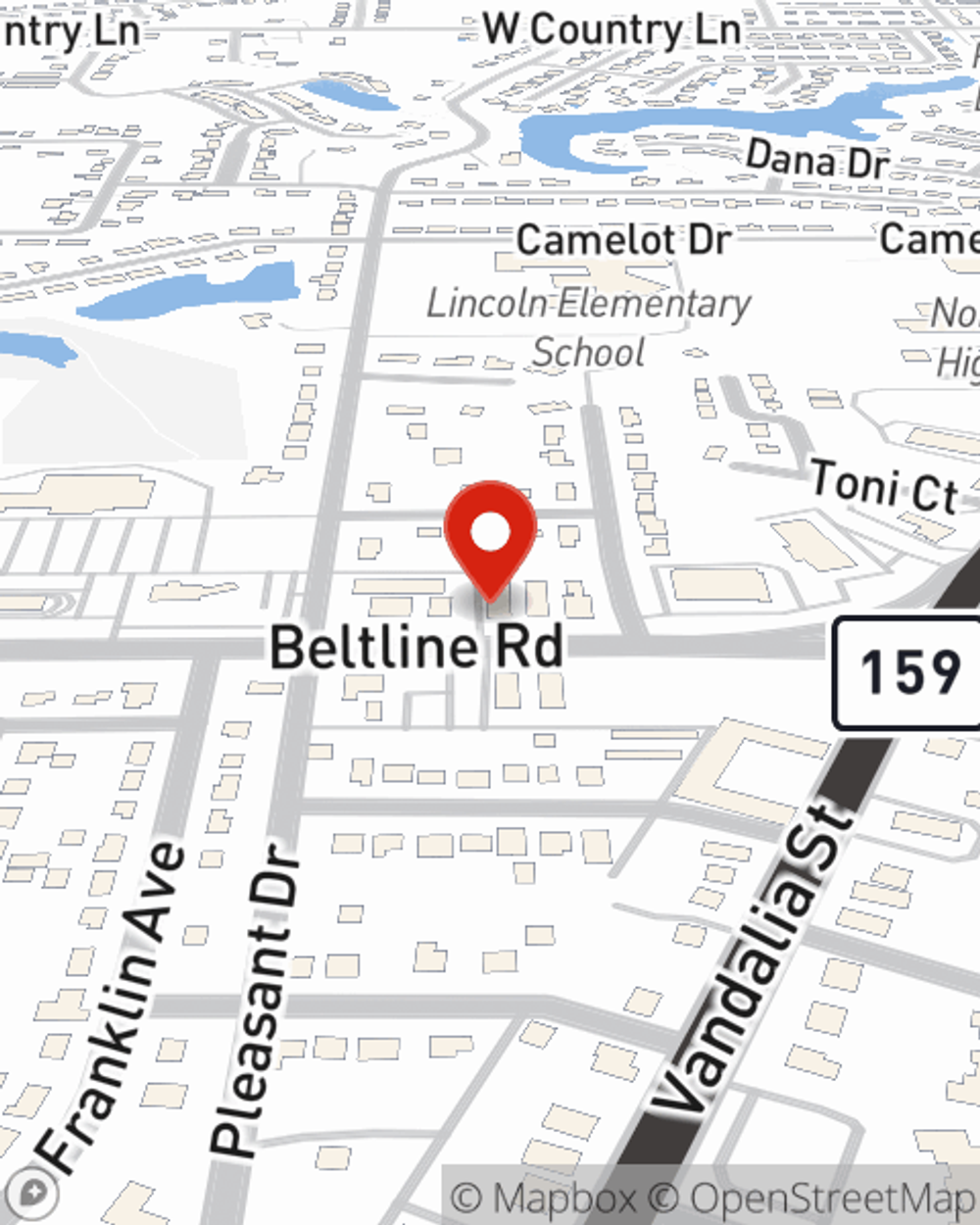

Business Insurance in and around Collinsville

Looking for small business insurance coverage?

Helping insure small businesses since 1935

- Edwardsville

- Madison County

- St. Clair

- Fairview Heights

- Maryville

- O'Fallon

- Troy

- Granite City

- Belleville

- Clinton County

- Glen Carbon

- Caseyville

- Pontoon Beach

- St. Louis

- Alton

- Godfrey

- Highland

- St. Jacob

- Mascoutah

- Lebanon

- Swansea

- Shiloh

- Scott Air Force Base

- Trenton

This Coverage Is Worth It.

When you're a business owner, there's so much to remember. We understand. State Farm agent Bobby Simpson is a business owner, too. Let Bobby Simpson help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Strictly Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your wages, but also helps with regular payroll overhead. You can also include liability, which is vital coverage protecting your financial assets in the event of a claim or judgment against you by a visitor.

Call or email State Farm agent Bobby Simpson today to check out how one of the leading providers of small business insurance can ease your business worries here in Collinsville, IL.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Bobby Simpson

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.